Here at our training centre we have provided Electrician training courses for almost 20-years! Giving people the knowledge and ability they need to set out towards a new career. We offer a complete range of courses from the basics to some of the most advanced qualifications an electrician can achieve, however, what happens after they have completed their training?

Of course our students will do off and find themselves in all types of different roles across the industry and some will eventually look to become self-employed. To do this successfully, you will need to set yourself up as sole trader as soon as your self-employed earnings surpass £1,000 during the financial year. Today, we are going to look at how this process works, how you can make this simple and straightforward as well as how to tackle keeping track of earnings, outgoings and things like invoices...

Setting up as a 'Sole Trader' is pretty simple and can be done on www.gov.uk/set-up-self-employed! On the webpage you will see that the process is laid out in steps covering things such as what name you would like to trade under and how to register a trademark.

However, what you really want to keep in mind is that you make note of the two most important pieces of information which are your Unique Taxpayer Reference or UTR as this will be needed every time you make tax payments, complete your Self-Assessment and every time you need to contact HMRC. The other is your Government Gateway user ID which will act as your login username or ID for your HMRC Tax Account and to complete your Self-Assessment once a year!

Keeping track of finances:

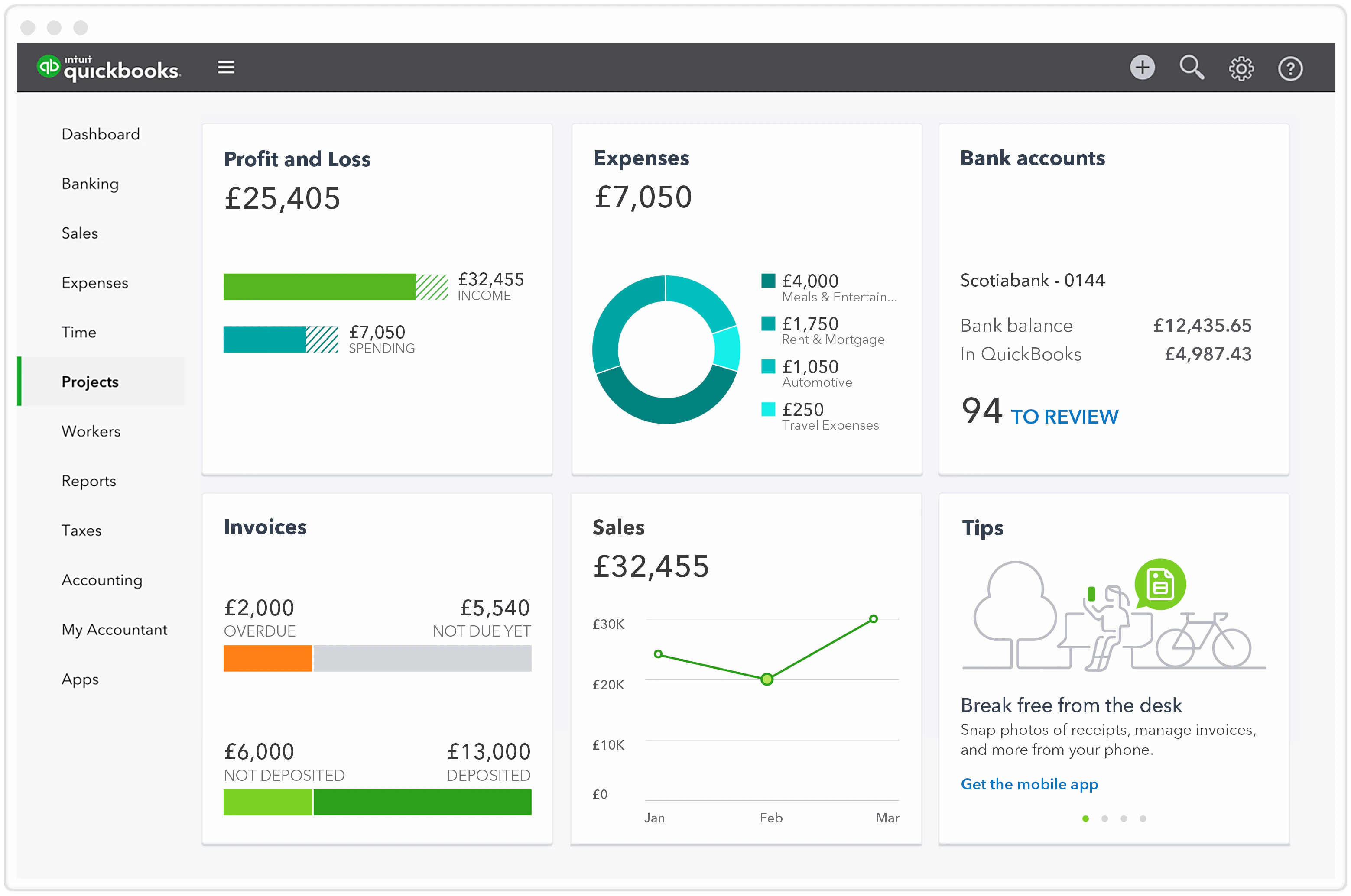

If you have never really had the reasonability to keep up with finances it can frustrating. To make life simpler for yourself and to allow yourself to focus on the work itself it is a good idea to invest in software such as Quciken or Quickbooks which will help you to manage everything, have everything in one place and give you a complete financial picture at a glance - Most options similar to these will have a mobile app making it easy to refer to whilst out on the job and generally on the go.

Alternatively, it might be a good idea to hire an accountant to help you with your bookkeeping. Either of these options are vital when it comes to working on a self-employed basis as you will have to complete a yearly Self-Assessment which will calculate the amount of Income Tax and National Insurance Class 2 and Class 4 contributions.

Registering as a limited company:

Depending on the amount that you are earning it may be beneficial to register as a limited company instead of going the sole trade route. The main difference between these two options is that if you want to operate as a sole trader, you will be completely responsible for your business and its finances. Whereas if you look to register as a limited company you have limited liability.

As a limited company the business itself is a separate entity in the eyes of the law. This is important to know as if you have business debts as a sole trader or your business goes bust your personal finances and assets are in danger. This is because legally there is no difference between your assets and the business’ assets.

So, overall it’s better in some cases to create limited liability as your personal finances and assets are protected should there be problems with the business finances. Maybe you start out as a sole trader for a year and once you have established yourself in the industry move forward and set-up a limited company.

Do you have a business partner?

If you are looking to start working in the self-employed world with a partner then there is a final option. If you have a trusted partner then you can jointly share the responsibility of your business which include losses, bills, stock and equipment.

As partners in a business you will share everything including profits from any work under the business's name. You must register your partnership for Self Assessment with HM Revenue and Customs (HMRC) if you’re the ‘nominated partner’. This means you’re responsible for sending the partnership tax return, however, both parties will need to submit tax returns as individuals. You must also register for VAT if your VAT taxable turnover combined is more than £85,000.

For more on what we do:

If you have any questions about our range of Electrician courses feel free to give us a call on 01322 280 202 - We are here to help in any way that we can whether you are looking for some general advance, ask some question or just gain some insight into what we do here.

You are also completely welcome to visit our training centre in person, our office is always open to anybody interested in training with us. We just ask that at this time you are conscious of social distancing and wear a face covering whilst talking to our staff. Our office is open 7-days-a-week between the hours of 8:30 - 16:30!

Find us at:

- Top DIY tasks to tackle at home

- How to set up your own plumbing business

- Start a career in tiling

- How quickly can you train as a plumber?

- Change your career with our decorating courses!

Industry-recognised City & Guilds Electrician Qualifications.